Married couples with debt can improve their financial health through low-interest debt consolidation loans, saving on interest and simplifying repayment. This requires strategic planning, maintaining excellent credit scores, and demonstrating responsible borrowing behavior to access favorable loan rates.

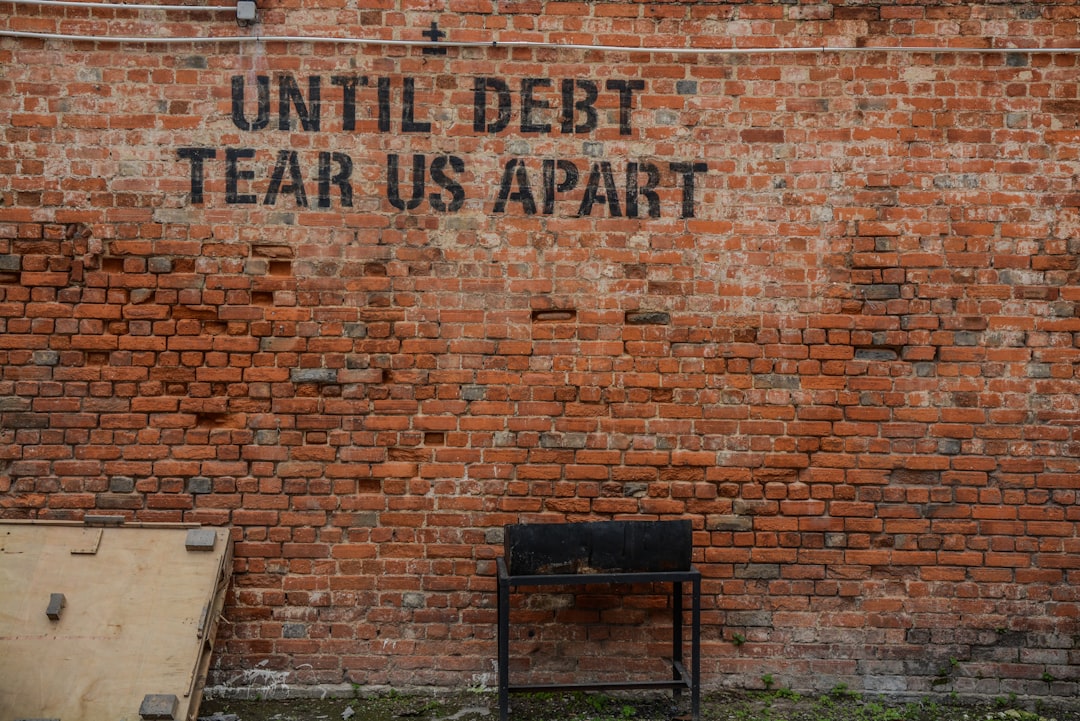

For many married couples, managing debt can be a challenging yet essential step towards financial stability. One effective strategy to tackle this is through joint debt consolidation loans, especially when facing high-interest rates across multiple debts. This article explores how couples can leverage low interest debt consolidation loans to simplify repayment and save money. By understanding the process and implementing strategic approaches, you can navigate the journey towards financial wellness together.

- Understanding Joint Debt Consolidation Loans for Couples

- Securing Low Interest Debt Consolidation Loans: Strategies

Understanding Joint Debt Consolidation Loans for Couples

Married couples facing debt challenges can find a collaborative solution with joint debt consolidation loans. This financial strategy allows both partners to pool their resources and apply for a single loan with a lower interest rate, consolidating multiple debts into one manageable payment. The primary advantage lies in the potential for significant savings on interest expenses over time, providing relief from the burden of high-interest debt.

By taking out a low-interest debt consolidation loan, couples can simplify their financial obligations and reduce the stress associated with multiple repayments. It offers a structured approach to paying off debts more efficiently, often with terms tailored to fit their combined income and budget. This unified front in managing finances can strengthen the couple’s financial foundation and pave the way for better long-term monetary health.

Securing Low Interest Debt Consolidation Loans: Strategies

Securing low interest debt consolidation loans involves strategic planning and understanding various factors. One key approach is to maintain a strong credit history, as lenders often offer lower rates to borrowers with excellent credit scores. Regularly reviewing your credit report for errors or discrepancies and promptly disputing any inaccuracies can help improve your score over time.

Additionally, couples should consider their overall financial health and debt-to-income ratio when exploring consolidation options. Lenders assess the likelihood of repayment based on income stability and existing debt obligations. Demonstrating responsible financial management through consistent on-time payments and minimizing new debt applications can significantly enhance the chances of securing low interest rates on debt consolidation loans.

For married couples facing debt challenges, joint debt consolidation loans with one income can offer a strategic solution. By understanding the basics of these loans and implementing secure strategies for obtaining low interest rates, partners can collaborate to simplify their financial landscape. This approach not only streamlines repayment but also paves the way for a more prosperous future, free from the burden of high-interest debt. Embracing informed decision-making regarding low interest debt consolidation loans is key to achieving these goals together.