Unemployment can lead to debt spirals. Low-interest debt consolidation loans combine multiple debts into one with flexible repayment options, simplifying financial management and offering mental relief. These loans cater to income uncertainty, enabling individuals to focus on stability before tackling consolidated debt. By freeing up cash flow, borrowers can prioritize essential expenses or job training, ultimately regaining financial control.

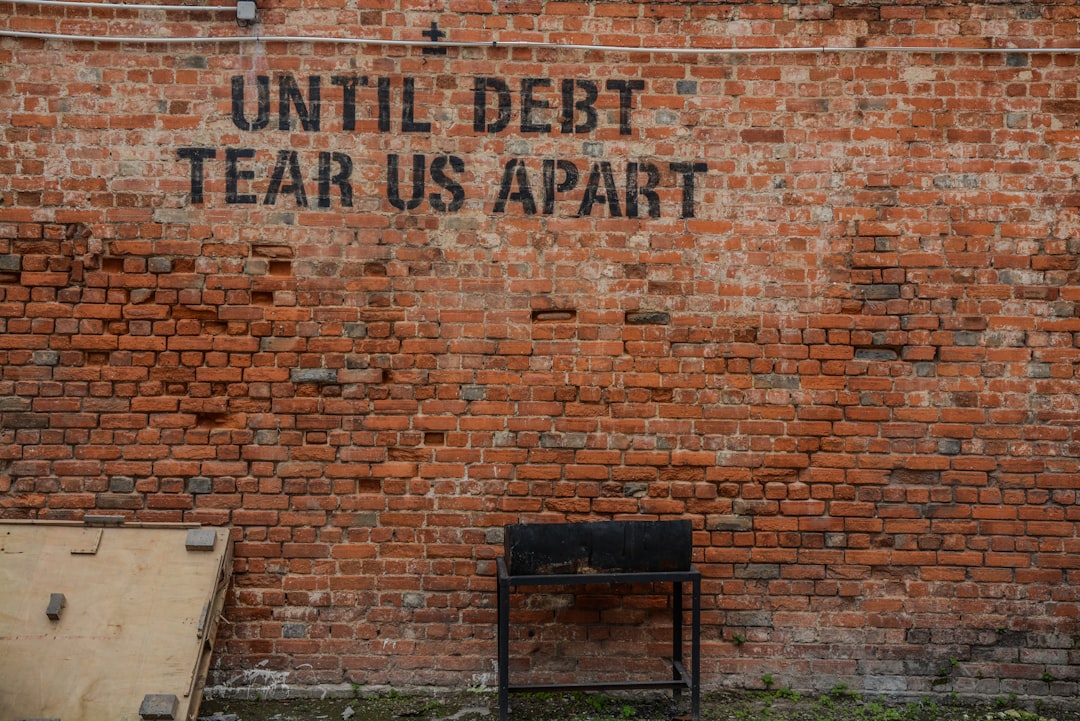

Unemployment and mounting debt can be a challenging combination, but relief is available through low-interest debt consolidation loans. This article guides you through understanding common financial struggles, particularly in times of job loss, and explores how flexible repayment options on these loans can provide much-needed debt relief. By opting for low-interest consolidation, individuals can simplify their finances and regain control over their economic future.

- Understanding Unemployment and Debt Challenges

- Low-Interest Debt Consolidation Loans Explained

- Flexible Repayment Options for Debt Relief

Understanding Unemployment and Debt Challenges

Unemployment can exacerbate financial strains, leading many individuals into a web of debts. This challenging period often results in a pileup of various loans and credit card bills, creating a complex repayment burden. The situation is further complicated by the psychological toll it takes, making it difficult for folks to prioritize debt management.

Debt consolidation loans with flexible repayment options step in as a viable solution during these trying times. Low-interest debt consolidation loans allow borrowers to merge multiple debts into one manageable loan, simplifying repayment processes. This strategy not only eases the mental stress but also offers financial relief by potentially reducing overall interest payments.

Low-Interest Debt Consolidation Loans Explained

Low-interest debt consolidation loans are a financial tool designed to help individuals manage multiple debts by combining them into a single loan with a lower interest rate. This approach simplifies repayment, making it easier for borrowers to stick to a structured plan and save money in the process. By consolidating debts, lenders aim to provide a more affordable and accessible solution compared to maintaining several high-interest loans.

These loans offer flexible repayment options, allowing borrowers to spread out their payments over an extended period. This flexibility is particularly beneficial for those facing unemployment or struggling with income uncertainty, as it provides breathing room to focus on financial stability before tackling the consolidation debt in a manageable manner.

Flexible Repayment Options for Debt Relief

When facing unemployment, managing debt can seem overwhelming. However, low-interest debt consolidation loans with flexible repayment options offer a lifeline. These loans allow individuals to combine multiple debts into one manageable loan, simplifying payments and potentially reducing interest rates. With flexible repayment terms, borrowers can choose a plan that aligns with their financial capabilities, making it easier to stay on track and avoid defaulting.

This approach provides much-needed relief by easing the burden of monthly payments. By structuring repayments according to personal circumstances, individuals can free up cash flow, which may be used for essential living expenses or even job training and skills development. Such flexibility is crucial in helping those affected by unemployment regain financial stability and chart a course toward a brighter future.

Unemployment and debt can create a challenging cycle, but low-interest debt consolidation loans with flexible repayment options offer a lifeline. By combining multiple debts into one manageable loan at a lower interest rate, individuals can simplify their financial obligations and regain control. Flexible repayment terms further alleviate stress, allowing borrowers to tailor payments to their income and preferences. This approach provides not just relief but also a clear path to financial stability, empowering those affected by unemployment to rebuild their financial future with confidence.